Oaktree Capital Management

Manager Overview

Founded in 1995, Oaktree Capital Management is an asset management firm headquartered in Los Angeles, California. The firm specializes in public equity, private equity, infrastructure, real estate, fixed income markets and alternative asset markets. The firm seeks to invest in crude petroleum, natural gas, coal, consumable fuels, environmental facilities services, cargo or container ships, consumer durables, apparel, movies, entertainment, retailing, beverages, food products, specialized finance, real estate and electric utilities sectors.

Known as:

OAKTREE

Website:

Telephone:

+1 (213) 830-6300

Email:

Investments

AUM:

Dry Power:

£217.8B

£21.31B

Exits:

391

Entity Types:

Asset Manager

Public Company

Lender

Active Portfolio:

Investments (TTM):

179

81

Total Investments:

Investor Status:

Actively Seeking New Investments

968

PE Deals

Investor Types:

859

Asset Manager (Primary Type)

Lender/Debt Provider

Growth/Expansion

Infrastructure

Mezzanine

PE/Buyout

Real Estate

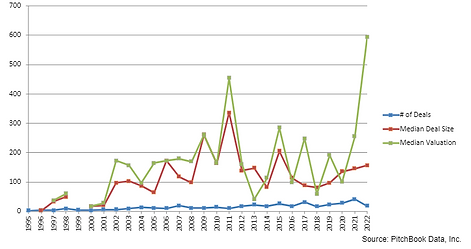

Yearly Investments Trendline

Investments by Industry

PM Alpha ODD conducted an initial operational due diligence (ODD) review of Oaktree Capital Management, including an evaluation of the Oaktree Opportunities Strategies and the Oaktree Special Situations Strategy. Oaktree Capital Management is a global alternative investment management firm that was founded in 1995 by Howard Marks, Bruce Karsh, Larry Keele, Richard Masson, and Sheldon Stone. The firm manages a diverse range of investment strategies, including distressed debt, corporate debt, real estate, and convertible securities, with a strong focus on risk management and a disciplined investment approach.

The ODD process evaluated the operations and non-investment aspects of the Manager, including a desk-side based review of all relevant documentation, although an onsite review has not yet been undertaken. PM Alpha ODD noted that Oaktree overall highlighted no material issues of concern and received a rating of ‘no material issues of concern’ across all 11 categories, however, it should be noted that this is only an initial review.

In September 2019, Brookfield Asset Management acquired approximately 61.2% of the Oaktree business in a transaction valued at approximately $4.7 billion, and the combined entity is now one of the largest alternative asset managers in the world, with over $600 billion in assets under management. Overall, the initial ODD review of Oaktree Capital Management found no material issues of concern, and further due diligence is recommended to fully evaluate the investment opportunity.

OVERALL RATING

1. Corporate & Governance Structure

2. Organisational Structure

3. Service Providers & Counterparties

4. Valuations & NAV

5. Financing & Cash Management

6. Fees & Expenses

7. Technology, Cybersecurity, DR/BC

8. Regulations, Legal & Audit

9. Compliance & Conflicts of Interest

10. Affiliated Transactions & Entities

11. ESG, Diversity & Inclusion

sales@pmalpha.co.uk | +44 20 388 38083

8-10 Adam House, Adam Street, London WC2N 6AA

1. Private Markets Alpha Limited is an Appointed Representative of Blackheath Capital Management LLP (FRN: 551769) which is authorised and regulated by the Financial Conduct Authority in the UK. The contents of this website have been approved by Blackheath Capital Management LLP. The content on this website is owned by Private Markets Alpha Limited and our licensors and by using this website you agree to our Terms and Conditions and Online Privacy Notice and Cookies Policy. 2.This website is only directed and may only be distributed to persons who are Professional Clients or Eligible Counterparties, *Qualified retail clients may only access the products from this website through and where they are a direct client of a regulated firm. This website and its contents are not, under any circumstances, intended for distribution to the general public. 3. The funds that may be referred to are Unregulated Collective Investment Schemes for the purposes of Section 238 of the Financial Services and Markets Act 2000 and alternative investment funds as defined under the Financial Services and Markets Act (The Alternative Investment Fund Managers Regulations 2013) and under COBS 4.12 of the FCA’s Conduct of Business Sourcebook.